I think you have a misunderstanding of what we were working under with the Framework MOA...

We were expecting roughly 3.5-5 million per year of incremental gains in interest arbitration in DC improvements, benefits and expenses - without concession - that was agreed to and that is from LRD.

The union and corporation already agreed to gains. The guidance for the arbitrator was explicit.

If I recall correctly, the TBP estimated cost, above the existing 2012 DC plan cost, over the next 7 years was 5 million. That's from MH - the pension chair.

5 million over 7 when we were expecting on the low side 3.5 million per year of incremental gains.

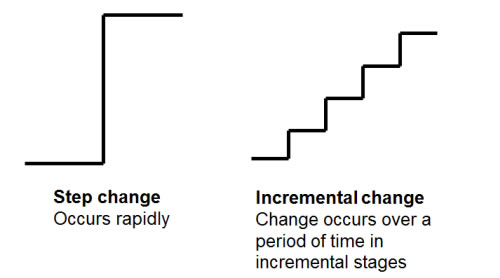

ie. 3/7/10/14/17/21/24 = ~95 million over 7.

Had we taken "LITTLE" steps our gains would be $95 million tall after 7 years.

Instead we took a "BIG" step which it turns out is only $5 million tall after 7 years.

You mention a lot can change over 3 years and that is true, but unlike many private sector arbitration agreements, mention of ability to pay, or business unit performance, or competitiveness is absent in our Framework MOA. Again, the language clearly supports that both parties intended and expected incremental gains. That's straight from LRD.

So given this $95 vs $5 million... and the fact that we threw down millions and millions in concessions... do you see where we went wrong?

We way overpaid. We left millions on the table.

We rushed and were pressured on an artificial timeline that was set alight by everything from:

"CWIPP may not be available" to:

"The arbitrator is already booked for the end of August" to:

"It will be too expensive to get gains in 2020"

Fact is:

of course CWIPP will be available, they are actively seeking additional groups to join - what fund doesn't want $millions more to manage?

Arbitrators are flexible because of the nature of what they work in.

the price in 2020 was costed and factored out this year, just like it would have been in 2020... there is no difference.

Again, I'm glad you got what you wanted, but you threw down too much for the surety of it.